I recently gave a presentation at Midwest Dreamin‘ on What’s the Right Way to Track Your Nonprofit’s Fundraising in Salesforce. An attendee had a great question that stumped me: what’s the best way to track donations from donor-advised funds (DAFs)?

I did some investigation into what best practices are. Unfortunatley, I came away with a bit of a frustrating answer: It depends.

Two general methods are common practice. One approach will work better if your Salesforce data must match your accounting system and Contact Hard Credit represents tax-deductible giving. The other will work better if it’s more important for the process to be intuitive for Development and Contact Hard Credit to represent total giving, including both tax-deductible and non-tax-deductible gifts.

What’s a DAF?

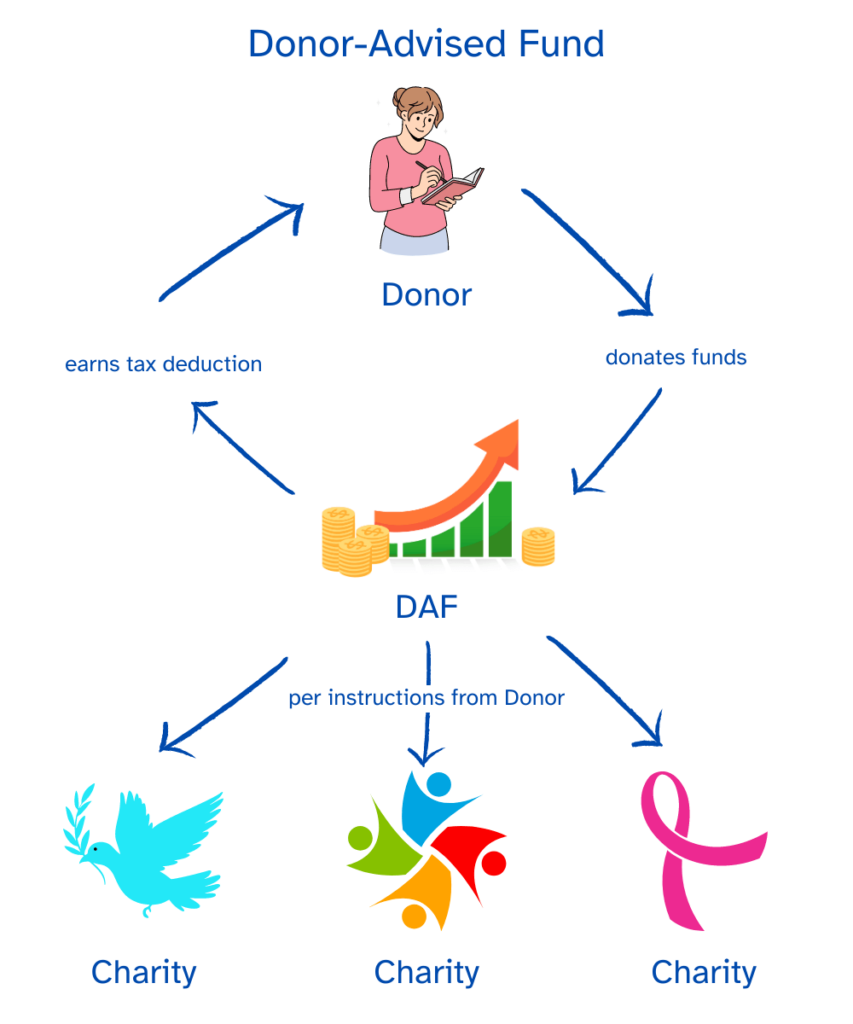

A Donor-Advised Fund (DAF) is a vehicle for charitable giving in which a donor can commit money to nonprofits. DAFs are administered by firms (e.g., Fidelity) that will invest the funds. This allows them to grow and then distribute them to the donor’s recommended charities over time.

DAFs offer donors several advantages:

- They simplify giving by letting donors send gifts to a single place, negating the need to personally track their many different payments to many different charities. The fund administrator does that work for them.

- Rather than giving the gift to the nonprofit immediately, funds in a DAF can be invested and grow over time. DAF contributions get more bang for their buck, as both initial investment and dividends from investment can be given to the donor’s preferred nonprofits.

- DAFs let donors establish succession plans to ensure their assets are endowed to the donor’s preferred charities when they pass away.

Here’s an illustration of how this works:

Why Are DAFs a Challenge for Nonprofits to Track?

This model works great for donors, but it can be a pain for the nonprofits who receive funding to track and understand what a donation from a DAF means.

The firm administering the DAF (e.g., Fidelity) is the entity that sends the gift to the charity. The firm administering the DAF doesn’t necessarily support the nonprofit’s work, though. They act as a middleman—the DAF’s donor ultimately supports the nonprofit.

This creates a disconnect for Development. How do you know to cultivate the relationship with the donor even though they don’t send your organization the money?

Additionally, DAF donations present a practical challenge. These gifts are not tax deductible. (The donor already got their tax deduction when they contributed to the DAF.) Any language about the donation being tax deductible must be removed from the acknowledgment letter.

Tracking DAF Donations in Salesforce NPSP

Using NPSP, there are two ways we would recommend tracking DAF donations. The one that your organization should use depends on your organization’s needs.

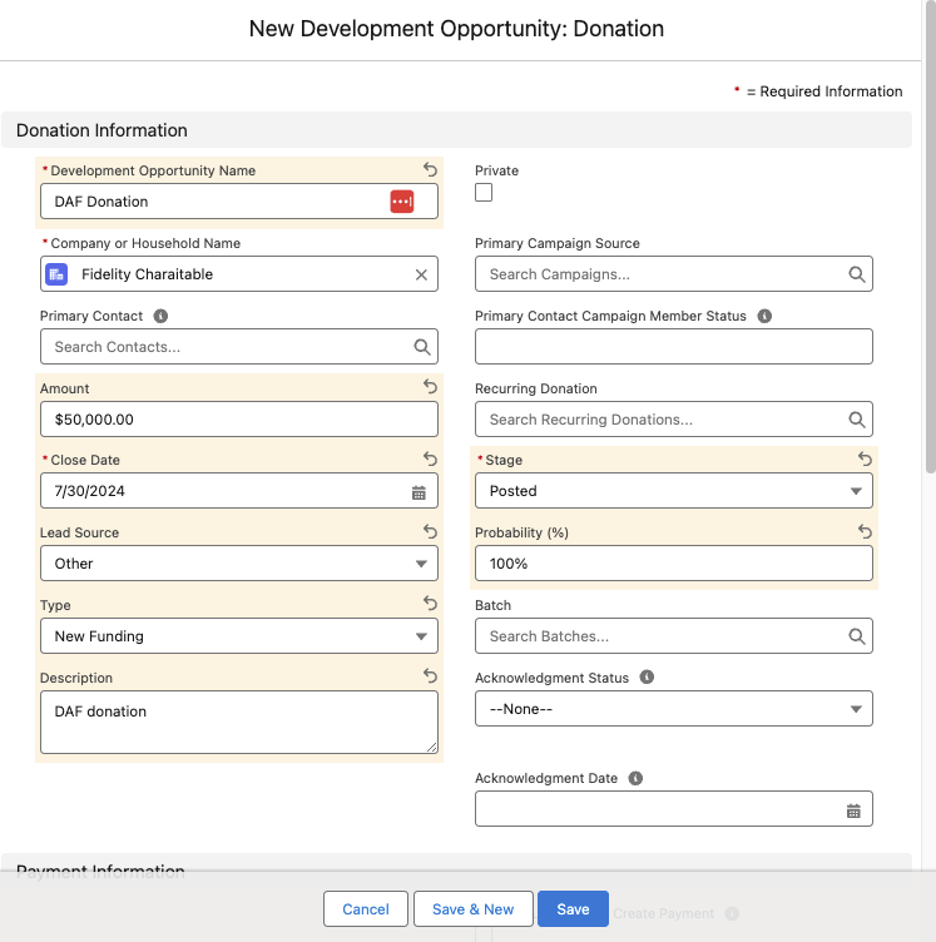

Option 1: DAF Administrator as the Opportunity’s Account

This option works well for organizations that need their CRM tightly integrated with their accounting system and need their CRM data to make audits as easy as possible. It also works well for organizations that want Contact Hard Credit to reflect specifically tax-deductible giving and for organizations that need to easily track donors’ giving preferences (e.g., needing to know who DAF givers to better formulate solicitation strategies). If your organization has these needs, we recommend creating an Organization Account record for the organization that administers the DAF (e.g., Fidelity). When you get a DAF donation, create a Donation Opportunity and select the DAF administrator organization as the Opportunity’s Account.

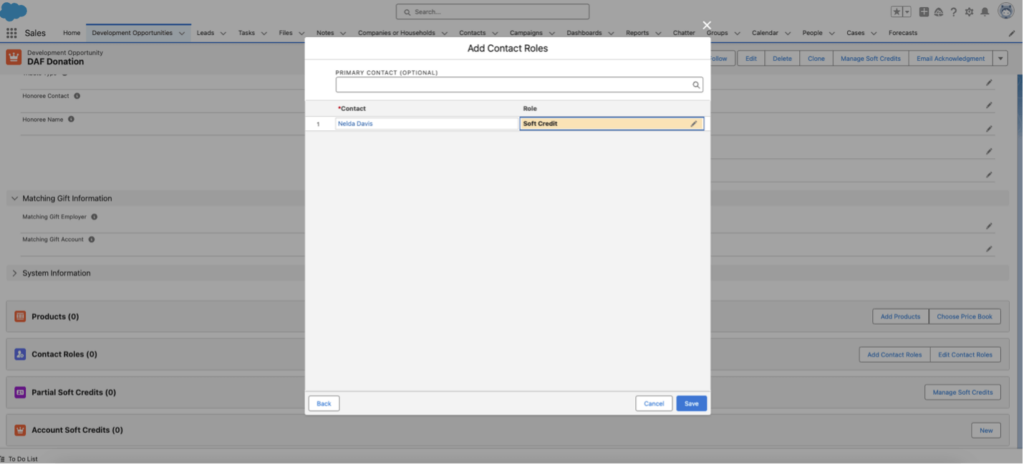

Then, you can add the donor(s) to the Opportunity’s Contact Roles with the role of “Soft Credit.”

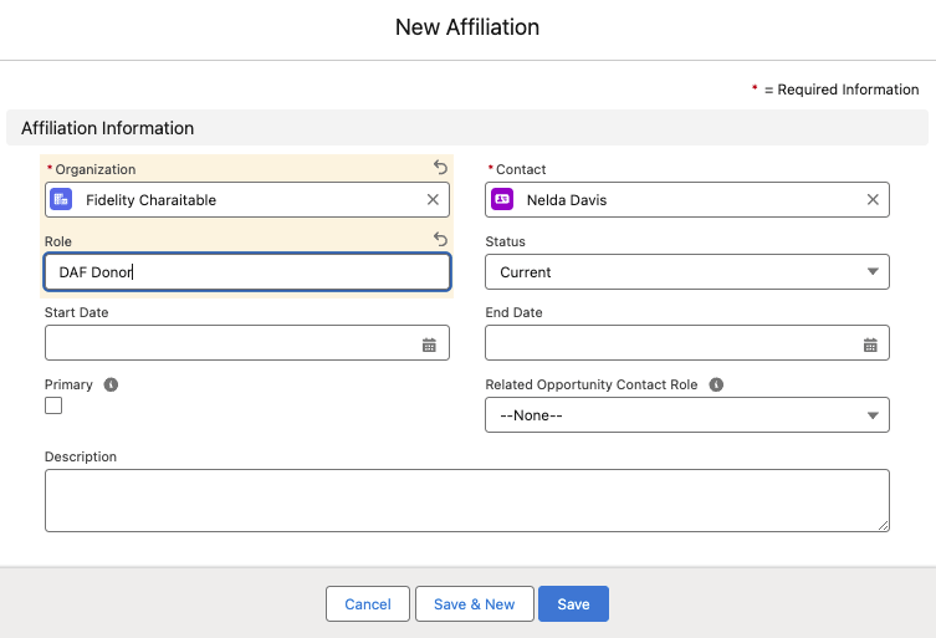

To track donors who give through DAFs, create Affiliation record(s) linking the DAF administrator organization to the Contact. Then set the Affiliation’s Role to “DAF Donor” so that you can easily pull a report to find all your donors who give through DAFs and see who administers their DAFs.

Easily Automate Creating Affiliations with a Flow

You can easily automate the process of creating affiliations with a flow.

This approach offers several advantages:

- It accurately reflects the institution that sent the DAF donation to your organization. This will flow more seamlessly into your accounting system and be easy to reconcile during audits.

- It lets you leverage Salesforce NPSP’s Hard Credit rollup fields to track the tax-deductible amount that a donor has given.

- You can use Hard Credit data to send end-of-year notifications of “total” giving. Then your donors can have documentation of their tax write-offs.

- Linking donors to their DAF administrator organizations allows you to easily pull that information.

However, this approach has a few drawbacks:

- It is much more difficult to understand what giving looks like when viewing a Contact record. Salesforce NPSP uses Soft Credit to account for donors influencing someone else to give, another member of the donor’s household donating to your organization, and other such contributions. Viewing a Contact’s Soft Credit and Hard Credit thus provides development with a muddled or deceptive picture that requires more digging.

- With the right filters, you can generate Contract Role reports to work around this challenge. Still, it will be more difficult than creating a summary report of Donation Opportunities by Primary Contact.

- This approach requires your users to be disciplined about data entry and always create Contact Roles on these Opportunities.

Option 2: DAF as Payment Type

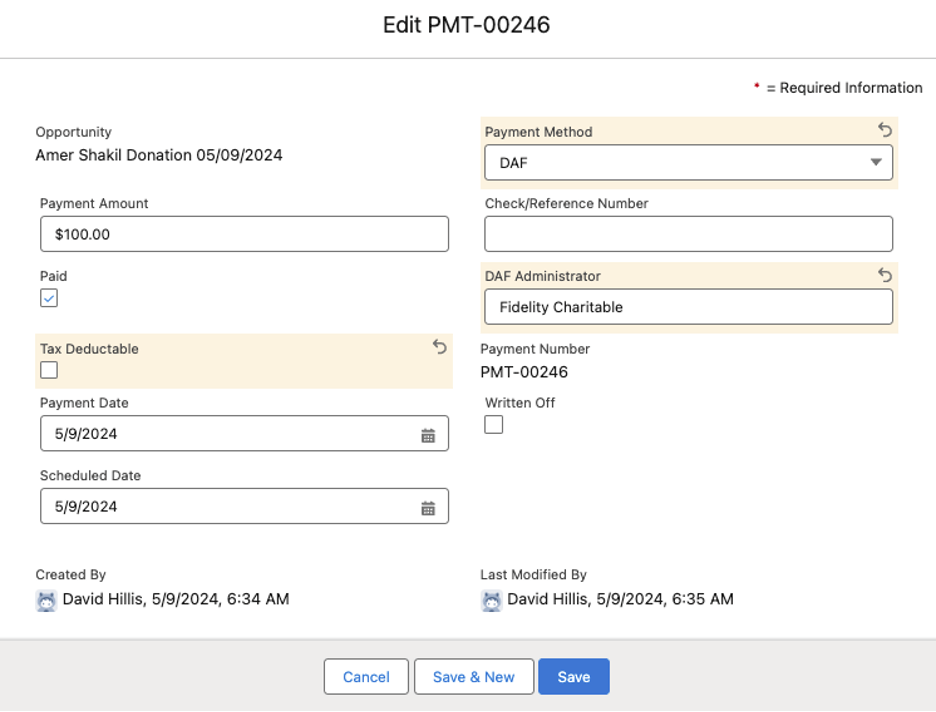

If it is less important for your CRM to match your accounting system exactly, your organization wants Hard Credit to reflect total giving rather than only tax-deductible giving, or development doesn’t require an extremely detailed understanding of their donors’ giving preferences, this option is a good fit for your organization. I first saw this approach recommended by https://kolodner.com. I think it’s a very effective way to handle this use case from a usability perspective. In this approach, as an admin, you can add “DAF” to the Payment object’s Payment Method picklist. Then you can create a DAF Administrator text field and Tax Deductible checkbox (default is checked) on the Payment object.

Adding a Validation Rule

To ensure data quality, add a Validation Rule to ensure that when Payment Method is DAF, the DAF Administrator field has a value and build a flow to uncheck the Tax Deductible checkbox when Payment Method is DAF. If you need to send out acknowledgments with tax-deductible verbiage, you’ll need to do a bit more work:

- Create a Rollup on the Opportunity called Tax Deductible Payment Amount that sums up the Payment Amount of all child Payment records with Tax-Deductible checked. (We recommend using Apex Rollups to do this.)

- Create a Text Formula field on the Opportunity called Tax Deductible Acknowledgement Text. The formula will be an IF statement so that if Tax Deductible Payment Amount >0, Tax Deductible Acknowledgement Text will have the tax-deductible verbiage and a line break. Otherwise, it will just be a line break.

- Create rollup(s) on the Contact for Tax Deductible Amounts over the periods of time relevant to your organization. (You can do this using Salesforce NPSP’s Customizable rollups.)

- If needed, create rollup(s) on the Account for Tax Deductible Amounts over the periods of time relevant to your organization. (You can also do this using NPSP’s Customizable rollups.)

This will allow your Development department to log a DAF Donation like any other Donation Opportunity, giving a donor hard credit for their DAF donations. Then, when creating the payment, they’ll log the Payment Method as DAF and input the DAF Administrator.

Advantages of This Approach

- It provides end users with a consistent workflow for logging donations.

- A Contact’s Hard Credit will represent the Amount that he or she has actually given, which is often more intuitive for Development to understand and gives a more complete and accurate picture of giving.

- It makes generating reports on Donor giving significantly easier than Option 1.

Challenges to This Approach

- Your CRM data will diverge from your accounting data, making audits more challenging.

- As an admin, you’ll need to build out infrastructure on the Opportunity, Contact, and potentially Account if you need to track the tax-deductible amounts a donor has given and update the data that populates on the donor acknowledgment letter to reflect this.

- You cannot easily pull data on the DAF administrator itself to see things like how much they have given if that is relevant to your organization.

- The DAF administrator will not receive acknowledgments or be credited for donations if that is relevant to your organization.

We Can Help

Salesforce is such a configurable system that there is no single right approach. Rather, the best approach will depend on your organization’s needs. If your nonprofit wants to get the most out of Salesforce to meet its needs, our team of certified Salesforce experts can help! Please don’t hesitate to contact us today.