Donor-advised fund tracking — It’s the worst great thing that can happen when you work in nonprofit fundraising. You spend considerable time qualifying, cultivating, and nurturing a major donor. You send them all the data that shows the good work your organization is doing. Then you share compelling stories to show how their gift will make a real difference. You ask for an eye-popping sum…and the donor says yes! You set your Opportunity Stage to Verbal Commitment in Salesforce.

You’re on top of the world, doing somersaults and backflips of joy until the donor says the most dreaded sentence in nonprofit fundraising, “I will have my DAF submit a payment.” Suddenly, your joy turns to dread, and your heart drops to your feet. You ask yourself, how the heck am I going to handle donor-advised fund tracking in Salesforce’s Nonprofit Success Pack (NPSP)?

Donor-Advised Funds (DAFs) are a great mechanism for charitable giving. I even discussed ways to log gifts from DAFs in some detail in a previous blog post. Today, I want to dive into a bit of a thorny question that builds on the two strategies discussed in that post: how do you deal with a pledge from an individual that gets fulfilled by a DAF? How can you ensure reliable donor-advised fund tracking?

What’s the Problem with DAFs?

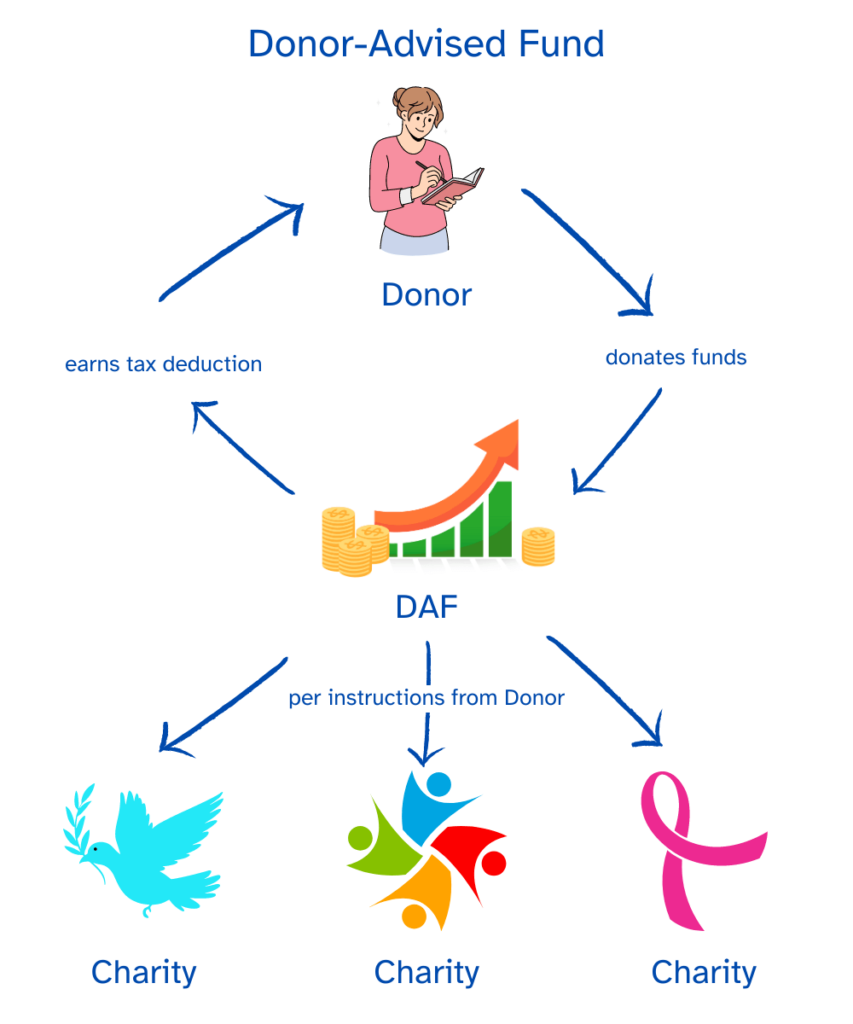

To understand the problem, let’s recap how DAFs work. Put simply, DAFs are vehicles for charitable giving in which donors can commit money to nonprofits. DAFs are administered by firms (e.g., Fidelity) that will invest the funds, allowing them to grow and then distribute them to the donor’s recommended charities over time.

DAFs represent a challenge for nonprofits tracking development using Salesforce’s NPSP because of a mismatch in the data: The donor directs the giving to your organization, but the gift is sent from the firm administering the DAF. This leads to all kinds of difficulty in understanding what’s actually happening with giving to your organization. For example, although it’s important to know that the DAF sent the gift, as giving from DAFs are not tax deductible, it’s also essential to know that the donor directed the giving so that you can easily track how important that donor is to your organization and continue to cultivate that relationship.

Having pledges paid by DAFs adds another wrinkle to this challenge. You’ve created a Major Gift Opportunity and diligently tracked all your qualification, cultivation, and solicitation activities. You have associated them with someone who has pledged to pay but the payment is provided from a different source. Donor-advised fund tracking is critical to good record-keeping and donor management, but it can be difficult to implement.

Two Solutions for Pledges Paid by DAFs

In my previous post, I mentioned two options for tracking DAF giving.

Option 1 for Tracking DAF Giving

List the DAF Administrator (e.g., Fidelity) as the Opportunity’s Account. Then give the Donor an Opportunity Contact Role of “Soft Credit.” This is the way to go if:

- Your organization’s governance requires you to have your CRM data match your accounting data as closely as possible.

- Your organization has its CRM tightly integrated with its accounting system.

- You need Hard Credit to represent the amount a constituent has actually paid.

Option 2 for Tracking DAF Giving

Add “DAF” as a selection to your Payment object’s Payment Method pick list. Then add a DAF Administrator text field and a Tax Deductible checkbox to the Payment object. This allows you to use the Payment object to track when Payments come from DAFs. This is a good option if:

- Your organization’s governance doesn’t require your CRM data to match your accounting data.

- Your organization’s CRM doesn’t need to be tightly integrated with its accounting system.

- You want your Hard Credit data to represent the person who directed the giving rather than the person/organization who provided the payment.

What to Do When the DAF Needs to Be the Opportunity’s Account

A great thing about Salesforce is that it allows you to easily update Opportunity data at any time. Accordingly, if you track DAFs as the Opportunity Account, once the payment arrives from the DAF, all you need to do is take three simple steps:

- Edit your Opportunity and change the Opportunity’s Account to the DAF Administrator (e.g., Fidelity Charitable).

- Remove the donor who pledged as the Primary Contact.

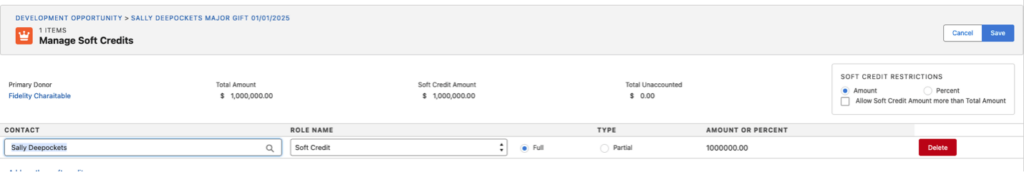

- Add the Donor who pledged to the Contact Role-related list with a role of “Soft Credit.” You can do this by pressing the “Manage Soft Credit” button on the Partial Soft Credits related list. Then select the donor as the Contact, set the role to “Soft Credit,” select “Full,” then pressing Save.

The good news is that reassociating the Opportunity Account and removing the Primary Contact don’t cause the activities to be associated with the DAF Administrator. You’ll still have insight into all your communication with the donor. The giving will now be reflected in that donor’s Soft Credit rollups, so you’ll have insight into the giving they influenced.

Remember that you might need to wait until the next overnight rollup job to run before the rollup data on the Donor and DAF Administrator is accurately reflected. If you need it sooner, manually press the Recalculate Rollups button on the donor’s Contact detail page and the DAF Administrator’s Account detail page.

What to Do When the DAF Data Is Tracked on the Payment

If you’re tracking the DAF as a payment method, I have some good news: you don’t need to take any action different from what you normally do. Just follow your normal workflow:

- Leave the Opportunity Account and Primary Contact as they are.

- Set the Opportunity Stage to your Closed Won stage.

- Navigate to the Opportunity’s Payment.

- Set the Payment Method to “DAF.”

- Add the DAF Administrator.

- Uncheck Tax Deductible.

- Press Save.

Expert Guidance for Your Nonprofit’s Unique Needs

Thanks to Salesforce’s flexibility, nonprofits have multiple approaches to handling DAF donations and pledges. Choosing the best path forward, however, depends on an organization’s specific requirements, accounting practices, and reporting needs.

Your Partner for Donor-Advised Fund Tracking in Salesforce

Soliant Consulting is a Salesforce Consulting Partner with 15 years of experience serving nonprofits. We help organizations optimize their NPSP implementations to handle complex scenarios like donor-advised fund tracking while maintaining clean, actionable donor data. We specialize in recommending and implementing solutions that align with our clients’ unique workflows and compliance requirements.

If you’re struggling with donor-advised fund tracking or want to optimize your donor management process, our Salesforce team can help. Reach out to learn more about how we can help your nonprofit make the most of its Salesforce investment.